Table of Contents

Investing in wine online has emerged as a fascinating avenue for both novice and seasoned investors alike. With the convenience and accessibility offered by online platforms, more people are exploring the world of wine investment.

In this section, we’ll delve into the fundamentals of Invest in Wine for Beginners Online, highlighting its increasing popularity and the benefits it presents to investors looking to diversify their portfolios.

Is Wine a Good Investment?

Wine can indeed be a good investment opportunity for those with a discerning eye and willingness to delve into the market. By selecting high-quality bottles from renowned regions and vintages, investors can potentially enjoy returns over time. However, it’s crucial to stay informed about market trends and exercise patience for optimal results.

Understanding the Basics of Wine Investment

Definition and Benefits

Wine investment involves acquiring bottles of wine with the expectation that their value will appreciate over time. It’s an alternative investment option that offers diversification benefits and the potential for attractive returns. Unlike traditional assets such as stocks and bonds, wine investment provides a tangible asset that can add depth to an investment portfolio.

Common Misconceptions

Contrary to popular belief, wine investment is not reserved solely for the wealthy elite or wine connoisseurs. Anyone with an interest in wine and a desire to explore alternative investments can participate in this market. Additionally, beginners need not possess extensive knowledge of wine; they can learn and grow their expertise over time.

Risks and Rewards

While wine investment offers the potential for lucrative returns, it’s essential to acknowledge and mitigate associated risks. Market volatility, counterfeit wines, and storage considerations are among the risks investors should be aware of. However, with proper research and guidance, investors can navigate these challenges and potentially benefit from wine’s long-term appreciation.

Getting Started with Online Wine Investment

Researching Wine Investment Platforms

Before venturing into online wine investment, it’s crucial to research and evaluate reputable platforms. Examples include Vinovest, WineBid, and Cavex, which offer access to a diverse range of investment-grade wines. By comparing features, fees, and user reviews, investors can select a platform that aligns with their investment goals.

Setting Investment Goals and Budget

Establishing clear investment objectives and budget constraints is paramount for beginners. Whether aiming for capital appreciation, portfolio diversification, or long-term wealth accumulation, defining goals helps guide investment decisions. Additionally, setting a budget ensures responsible investing and prevents overextending financially.

Choosing the Right Wines to Invest In

Selecting the right wines for investment requires careful consideration of various factors. Investors should analyze market trends, historical performance, and expert recommendations. For example, investing in renowned producers like Domaine de la Romanée-Conti or sought-after regions like Bordeaux can offer growth potential.

Wine vs Stock: Which Is a Better Investment?

When weighing the merits of wine versus stocks as investment vehicles, consider the impressive performance of wine indices like Liv-ex and Sotheby’s Wine Index. Over the past two decades, the Liv-ex Fine Wine 100 has soared by 270.7%, outperforming the S&P 500 by 8 percentage points, albeit without dividends reinvested. Sotheby’s Wine Index has consistently outshined the S&P 500 since 2005, particularly in markets like Burgundy and Bordeaux.

However, investing in wine requires careful selection and diversification, akin to assembling a well-rounded stock portfolio. Rather than focusing solely on individual bottles, prioritize quality and rarity to ensure long-term value and flexibility. As Alfonso de Gaetano of Crurated emphasizes, investing in quality wine offers both longevity and the potential for substantial returns.

Evaluating Investment-Grade Wines

Factors to Consider

When evaluating investment-grade wines, several factors come into play. Producer reputation, region, vintage, and critic ratings are among the key considerations. For instance, wines from established producers like Château Lafite Rothschild or acclaimed regions like Napa Valley tend to command higher prices and exhibit greater potential for appreciation.

Understanding Wine Quality

Investing in wines of exceptional quality is essential for maximizing returns. High-quality wines with aging potential and consistent tasting notes tend to perform well in the market. For example, vintage wines from outstanding years or those with high critic ratings often attract investor interest and command premium prices.

Utilizing Online Resources

Online resources such as wine databases, market reports, and expert reviews are invaluable tools for investors. These resources provide insights into market trends, pricing data, and wine quality assessments. Investors can make informed investment decisions by leveraging online platforms and expert guidance.

Buying Wine Online for Investment

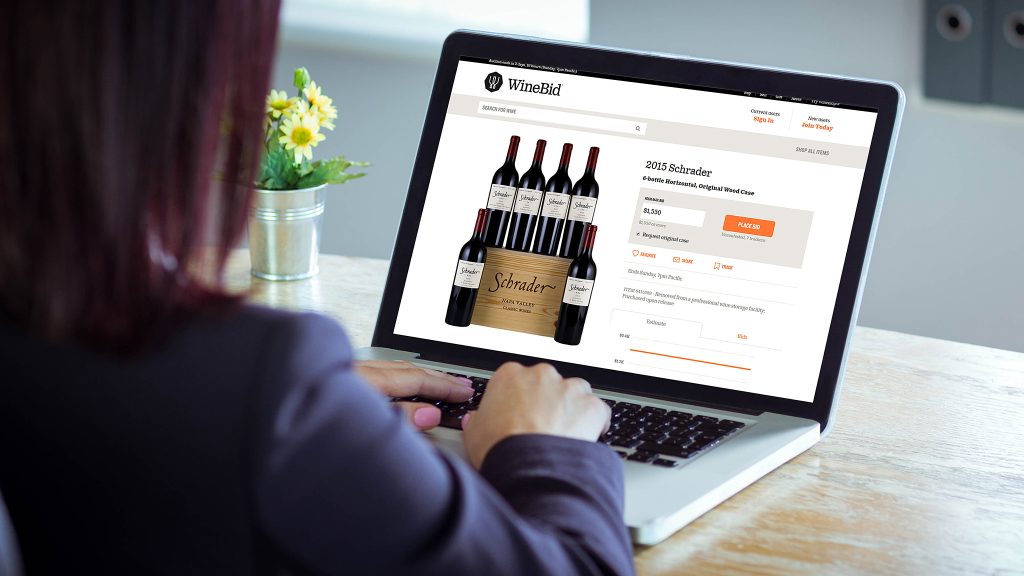

Exploring Online Wine Auction Houses

Online wine auction houses offer a convenient platform for purchasing investment-grade wines. Platforms like Sotheby’s Wine, Christie’s, and WineBid host auctions featuring a wide selection of wines. Investors can explore listings, participate in auctions, and acquire wines for their investment portfolios.

Step-by-Step Guide

Navigating the process of buying wine online involves several steps. First, investors must register on the auction platform and verify their accounts. Next, they can browse listings, research wines of interest, and place bids accordingly. Upon winning an auction, investors complete the purchase and arrange for delivery or storage of the acquired wines.

Negotiating Prices and Avoiding Pitfalls

When buying wine online, it’s essential to negotiate prices wisely and conduct thorough due diligence. Investors should be wary of counterfeit wines, inflated prices, and hidden fees. By researching wine authenticity, verifying provenance, and seeking expert advice, investors can avoid common pitfalls and make informed purchase decisions.

Managing and Monitoring Your Wine Portfolio

Tracking Performance and Valuation

Effective portfolio management involves monitoring the performance and valuation of wine investments over time. Investors can use online tools, portfolio trackers, and market analysis reports to track trends and assess portfolio health. Investors can make informed decisions regarding portfolio rebalancing and asset allocation by staying informed about market dynamics and wine prices.

Storing Wines Securely

Proper storage is essential for preserving the quality and value of investment-grade wines. Investors should consider factors such as temperature control, humidity levels, and security measures when storing wines long-term. Options range from home wine refrigerators to professional storage facilities, depending on the investor’s preferences and budget.

Adjusting Your Portfolio

Periodic portfolio adjustments may be necessary to maintain diversification and optimize returns. Investors should reassess their investment goals, risk tolerance, and market conditions regularly. By selling underperforming wines and reallocating capital to promising opportunities, investors can adapt their portfolios to changing market dynamics and investment objectives.

Tips for Success in Online Wine Investment

Diversifying Your Portfolio

Diversification is key to mitigating risk and maximizing returns in wine investment. Investors should diversify their portfolios by investing in wines from different regions, producers, and vintages. By spreading risk across various categories, investors can enhance portfolio resilience and capture growth opportunities.

Staying Informed

Continuous learning and staying informed about market trends are essential for success in wine investment. Investors should follow reputable wine publications, attend industry events, and engage with online communities to stay updated on the latest developments. By seeking knowledge and insights from experts, investors can make informed decisions and navigate the wine market effectively.

Seeking Advice

Seeking advice from experienced investors and wine professionals can provide valuable guidance and perspective. Investors can leverage their networks, join investment clubs, and participate in online forums to connect with industry experts and fellow enthusiasts. By learning from others’ experiences and seeking mentorship, investors can gain valuable insights and enhance their investment strategies.

Maintaining Discipline

Discipline is crucial for success in wine investment. Investors should adhere to their investment plan, avoid impulsive decisions, and stay focused on long-term goals. By maintaining discipline and sticking to predetermined investment strategies, investors can navigate market fluctuations and achieve their desired outcomes.

Final Words

In Final Words of How to Invest in Wine for Beginners Online offers an exciting opportunity for investors to diversify their portfolios and potentially earn attractive returns. By understanding the basics of wine investment, conducting thorough research, and following best practices, investors can navigate the wine market with confidence and maximize their investment success. Whether aiming for capital appreciation, portfolio diversification, or long-term wealth accumulation, online wine investment provides a unique avenue for investors to explore alternative assets and build wealth over time.